Driven by the dual forces of appearance-level economy and health consumption, the Chinese beauty instrument industry is undergoing a major transformation. It has now completed a profound shift from “exclusive for hospitals” to “essential for families”. The resonance between technological iteration and consumption upgrading has pushed the industry into a three-dimensional competition stage of “technology-driven + scenario innovation + ecological loop”.

I. Macro-environment Analysis

(1) Policies and Regulations: Transition from “small appliances” to “medical devices”

The National Medical Products Administration’s supervision of beauty instruments has become increasingly comprehensive, thereby making the industry more standardized. Starting from April 2024, RF beauty devices have been classified as Class III medical devices, requiring enterprises to obtain the NMPA registration certificate before production and sales. This policy directly led to an increase in industry barriers, and some enterprises with weak technology and insufficient compliance capabilities accelerated their exit from the market. At the same time, the “14th Five-Year Plan for the Development of Medical Equipment Industry” clearly supports the domestic production of high-end medical beauty equipment and encourages enterprises to strengthen the research and development of core components and clinical data accumulation, providing policy benefits for local brands to break through technical barriers.

(2) Economy and Consumption: Expansion of the middle class and the rise of the Z Generation drive demand

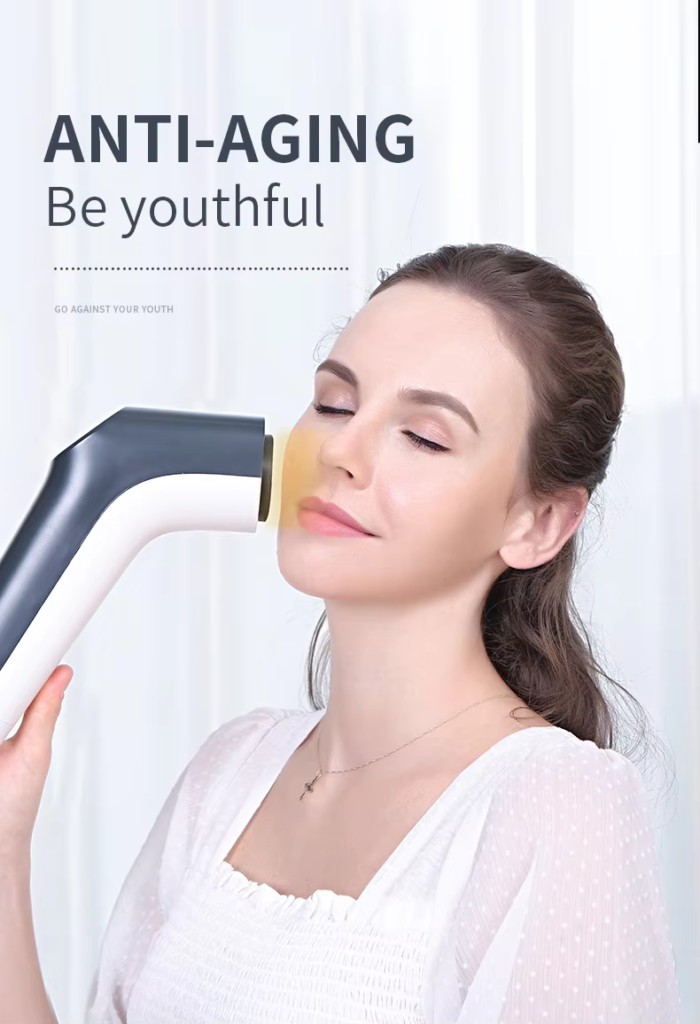

The scale of the middle class in China continues to expand, and the Z Generation (born between 1995 and 2009) has become the main consumer force, driving the beauty instrument market to evolve towards “high-end + personalized” dual tracks. According to data from the National Bureau of Statistics, China’s per capita disposable income in 2025 increased by more than 60% compared to 2020, and the improvement in consumption capacity directly increased the proportion of beauty care expenditures. The Z Generation pursues “tech-savvy + high appearance level”, driving the annual average growth rate of sales of portable facial cleansing devices, penetration devices, etc. to exceed 60%; the silver-haired group (aged 50 and above) has experienced an explosive growth in anti-aging demand, making RF devices, microcurrent devices, etc. for professional household use an important source of growth.

(3) Social Culture: Deep integration of appearance-level economy and health consumption

According to the “2026-2030 Edition Market Analysis and Related Technology in-depth Research Report on Beauty Instruments” by Zhongyan Puhua Industry Research Institute: “The concept of self-love consumption” has deepened, and consumers’ demand for beauty instruments has upgraded from “surface decoration” to “life management”. Anti-aging, deep cleaning, and moisture retention have become core demands, and they show a “consumption stratification” feature: middle-aged groups prefer high-end anti-aging equipment, Z Generation favors affordable portable products, and the male market has rapidly risen due to anti-aging needs (starting from the age of 25). In addition, the rise of ingredientists and efficacyists has prompted enterprises to shift from “generalized care” to “precise solutions”, and specialized categories such as sensitive skin-specific, night skin repair, and male oil control and acne prevention have emerged.

II. Supply and Demand Analysis

(1) Demand Side: Home market dominates, professional market upgrades to intelligence

Home beauty instruments: Currently, they are increasingly occupying a dominant position in the market, accounting for over 65%. RF, light therapy, and microcurrent products, due to their clear anti-aging and firming effects, have become the preferred choice for consumers. Among them, RF devices stimulate collagen regeneration through controllable heat energy, light therapy devices use specific wavelengths to improve pigmentation, and microcurrent devices simulate biological electrical signals to exercise facial muscles, and the three together constitute the core growth pole of the home market.

Professional medical beauty instruments: Benefiting from the popularization of light-based anti-aging projects (such as photo anti-aging, water injection), the demand for professional equipment remains steadily growing. High-value-added equipment such as lasers, ultrasonic scalpels, and water light devices, due to their high technical barriers and large single-unit value, have become the core competition赛道 for international brands and domestic leading enterprises. At the same time, professional institutions have raised requirements for equipment intelligence and precision, driving the growth of multi-modal integrated equipment (such as RF + red light + microcurrent composite systems).

(2) Channel Structure: Online dominant, offline experience value re-evaluated Online channels: Live-streaming e-commerce and social platforms have become the core growth engines, accounting for over 70%. KOL reviews and scenario-based content shorten consumers’ decision-making paths, promoting the maturity of the “interest-driven e-commerce” model. At the same time, e-commerce platforms use big data analysis to achieve precise recommendations, increasing user repeat purchase rates.

Offline channels: Experience stores, cooperation with medical institutions, and DTC models strengthen user trust. Offline experience stores enhance the experience through technologies such as AR virtual makeup and skin testing. Some brands have established a closed loop of “online promotion – offline experience – repeat purchase explosion” to build brand moats.

III. Industry Trend Analysis

(1) Technology Integration: AI and IoT reshape user experience

AI algorithms use genetic testing and skin microbiome analysis to build user profiles, providing customized energy parameters and skincare solutions; IoT technology enables remote management of devices, tracking of usage effects, and reminder of consumables. For example, intelligent beauty mirrors can monitor skin pH values, elasticity, etc. in real time and automatically adjust the care mode when linked to household devices. Products with closed-loop systems that monitor skin conditions in real time and automatically adjust energy output will gradually become widespread in the future.

(2) Scenario Innovation: The boundary between home use and professional use blurs

Some brands transform in-line technology for home use, forming “light medical beauty” home devices; other home brands collaborate with medical institutions to provide equipment usage guidance and skin management plans, building a mixed model of “home care + professional services”. For example, portable laser hair removal devices, home radiofrequency microneedle devices, etc., “semi-professional level” devices achieve a balance between safety and efficacy, becoming new growth poles.

TAGS: HOME RF BEAUTY DEVICE, HOME RF BEAUTY EQUIPMENT, HOME RF BEAUTY MACHINE, RF BEAUTY DEVICE, RF BEAUTY EQUIPMENT, RF BEAUTY MACHINE

(3) Green Sustainability: Environmental-friendly materials and low-carbon operations become new trends

The application of degradable sensors and flexible electronic materials enhances device safety and environmental friendliness. Some brands use biobased materials to replace traditional plastics, reducing carbon footprints. At the same time, enterprises respond to ESG concepts by optimizing supply chain management and reducing packaging waste to meet consumers’ demands for sustainable consumption.

IV. Investment Strategy Analysis

(1) Core Asset Allocation: Focus on technological barriers and brand moats

Technological barriers: Prioritize enterprises with core patent reserves (such as RF energy control, optical module integration), AI algorithm optimization capabilities, and clinical data accumulation. For example, in the context of a rapidly increasing domestic rate of RF chip localization, enterprises with high-end RF generator technology have a competitive advantage.

Brand moats: Focus on brands that build user trust through all-channel operations (online live-streaming + offline experience) and occupy market segments with differentiated products (such as male-specific anti-aging equipment). For example, projects targeting contour management for professional men, hair loss services for men, and traditional Chinese medicine Thermage for the elderly, all have high growth potential.

(2) Satellite Strategy Layout: Capture early dividends of high-growth sectors

Male beauty market: Over 40% of young men under 30 invest significant amounts monthly in beauty and skincare, with anti-aging needs shifting to 25 years old. Specialized equipment developed for male skin types (such as oil secretion-promoting, large-pore-controlling devices) has explosive potential.

Anti-aging sector: Frontier technologies such as cell repair and gene editing drive an increase in average order value, with the demand for high-end anti-aging equipment (such as ultrasound knives, RF microneedle) continuing to grow. At the same time, the “inside-out” model combining oral anti-aging supplements with external devices has become a new trend.

TAGS: HOME RF BEAUTY DEVICE, HOME RF BEAUTY EQUIPMENT, HOME RF BEAUTY MACHINE, RF BEAUTY DEVICE, RF BEAUTY EQUIPMENT, RF BEAUTY MACHINE

(3) Risk Hedging: Pay attention to policy, competition, and trust risks

Policy risk: Closely track the dynamic of medical device classification management to avoid product removal due to compliance issues. For example, RF beauty devices need to be declared as Class III medical devices, and enterprises need to plan clinical trials and obtain registration certificates in advance. Competitive risk: Diversify investments across different market segments (such as household cleaning, professional anti-aging), avoiding excessive concentration in a single area. At the same time, pay attention to the positioning capabilities of the enterprise ecosystem, such as light medical beauty institutions that form barriers through exclusive equipment or technology, or brands that develop one-stop solutions based on the needs of working men.

Trust risk: Prioritize choosing enterprises with transparent and trustworthy mechanisms (such as “fixed price” pricing model, blockchain service process records) to reduce brand crises caused by false advertising and hidden consumption.